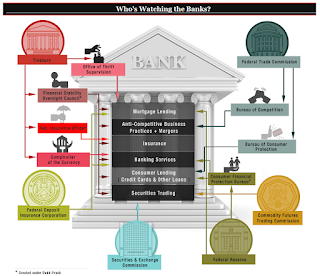

Paul Volcker has set out a new, somewhat dramatic vision for US bank regulation that deserves a good look. Volcker takes aim at what he might call the inefficient patchwork of oversight of the US financial systems and calls for a reshaping of the supervisory function.

Key proposals include a new Prudential Supervisory Authority, that would combine the current roles of the Fed, OCC, and FDIC, removing the OFR (the Office of Financial Research) from Treasury to an more independent footing, forming a new Systemic Issues Committee to designate SIFIs and consider shadow banking issues, and lastly merging the SEC and CFTC. Interestingly, Volcker doesn't take on the myriad of state regulations applicable to the financial sector.

Such a set of sweeping changes deserve debate and thought; although policy markers may resist these proposals given their scale and possible impact to any vested interests. You can find out more at Volcker's website at https://volckeralliance.org/.

Comments

Post a Comment